Another aspect of the transaction will influence the wage payable on the steadiness sheet underneath the liability section. We shouldn’t touch on the bills that already records in the earlier period if the earlier interval is closed or audited. Thus, this accrued salaries payable journal entry additionally makes certain that at the similar time wage is charged in the March accounts even when the cash is to part in the month of April. At the tip of yr, company has to incorporate the wage expense even it isn’t but paid. The company has to incorporate the unpaid quantity within the earnings assertion.

It becomes clear that you won’t be in a position to pay the owner for the primary month of hire until she will get back in touch with you. Quick ahead to the top of the month (let’s say it’s February), and you still haven’t heard from the landlord about cost. She won’t pick up the cellphone or reply her e mail, and her answering machine says she’s in Cuba. Your accounting methodology tremendously affects your monetary reviews and how you understand the financial health of your small business.

The firm cannot recognize the whole $1,200 as revenue as a outcome of it still owes the client 11 extra months of service. When this is the case, an estimated amount is utilized to each month in the yr so that every month reports a proportionate share of the annual cost. When the invoice is paid on 12/31, Taxes Payable is debited and Money is credited for $6,000.

Guidelines Supporting Adjusting Entries

When a company owes wages to its employees at the end of an accounting interval, it needs to account for this obligation. The wages which are owed however not but paid are known as “accrued wages” or “wages payable”. Often, when the company makes the funds for wages, it makes the journal entry by debiting the wage expense and crediting the money. This is the case where there is no https://www.simple-accounting.org/ accrued wages journal entry required. Learn tips on how to navigate accrued wage adjusting entries with clear examples and hold your books balanced. Software spreadsheets and accounting packages could make calculations simpler, particularly when you have several workers at completely different pay grades.

A company’s journal incorporates a chronological report of financial transactions. At the tip of a period salary payable entry is used to report the accrued but unpaid salaries. The salaries expense account represents the entire value of salaries for the interval and is a liability of the company to its workers.

- Let’s dig somewhat deeper into how this adjusting entry for accrued salary works.

- The transaction is in progress, and the expense is build up (like a “tab”), however nothing has been written down yet.

- We must do an adjusting entry to document the wage earned by employees from December 28 – December 31 of this yr.

- Curiosity had been accumulating through the interval and must be adjusted to reflect curiosity earned on the finish of the interval.

- Amassed Depreciation is opposite to an asset account, such as Equipment.

Let’s say a company pays $8,000 in advance for four months of rent. After the first month, the corporate records an adjusting entry for the lease used. The following entries show initial payment for 4 months of lease and the adjusting entry for one month’s usage. Deferred bills are prices that a company has paid prematurely for items or companies it’ll obtain or consume in future periods. These prepayments are initially recorded as property as a result of the corporate expects to derive future advantages from them.

Bookkeeping

According to the matching principle, expenses must be recorded in the identical period as the revenues they help generate. Failing to record accrued expenses would end in understated liabilities and bills. No journal entry is made at the beginning of June when the job is started. At the top of every month, the amount that has been earned during the month have to be reported on the earnings assertion.

Talking to a CPA may help you choose the strategy that’s greatest for you. Learn tips on how to construct, read, and use financial statements for your small business so you can make extra informed decisions. Not positive where to begin or which accounting service matches your needs? Our team is ready to study your corporation and information you to the proper solution.

This journal entry is made to get rid of the wages payable of $3,000 that company ABC has recorded in the January 31 adjusting entry. It is a prime instance of accrued bills that require adjusting entries. As A Outcome Of the date you pay your staff doesn’t all the time sync up along with your accounting period’s finish date. To maintain your books sincere (and the accounting gods happy), you have to record accrued salary payable.

Over time, as the benefits are realized (for instance, as the pay as you go services are used or consumed), the asset is lowered, and the expense is acknowledged. The firm had already accumulated $4,000 in Wages Expense throughout June — $1,000 for every of 4 weeks. For the 2 additional work days in June, the twenty ninth and 30th, the corporate accrued $400 further in Wages Expense. To add this extra amount so it appears on the June income assertion, Wages Expense was debited.

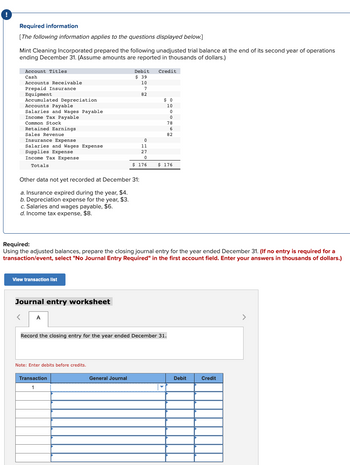

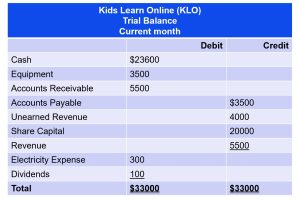

When the company collects this cash from its clients, it’ll debit cash and credit unearned fees. Even though not all the $48,000 was in all probability collected on the identical day, we document it as if it was for simplicity’s sake. He does the accounting himself and uses an accrual basis for accounting. At the top of his first month, he evaluations his records and realizes there are a number of inaccuracies on this unadjusted trial steadiness.